SunTrust doesn't disclose where its services are available on its website. If you're interested in its mortgages, contact a representative to see if it services your area.Does SunTrust offer refinancing? SunTrust offers interest rate reduction refinancing for veterans and cash-out refinancing.Does SunTrust sell its loans? The SunTrust site doesn't mention whether or not it sells its loans.What mortgage payment options does SunTrust offer?

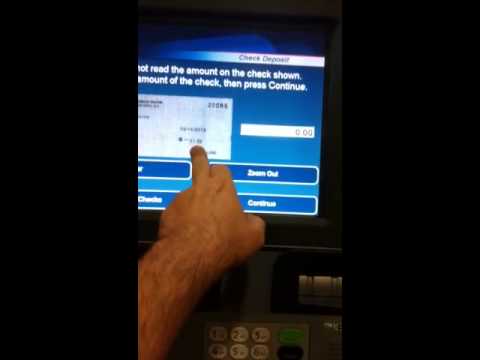

SunTrust offers a few payment options, including one-time payments, SurePay recurring payments and biweekly mortgage plans. You can easily pay online if you have a SunTrust bank account. Sofi Mortgage is a solid loan partner for the best loans in the market. They require a minimum credit score of 660 and a minimum down payment of 10% for customers seeking to collect a loan.

They provide full digital support for clients and do not require private mortgage insurance for jumbo loans. We also look at types of loans and what specific products are available. Finally, we look at the ability to get information online and to carry out online processes as well as customer service, rate information and complaints that have been filed. Eligible veterans can obtain 100% financing using their VA eligibility, to a maximum loan of $679,750, depending on the location of the property.

30-year fixed rate loans are the most commonly used VA mortgage program. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. The minimum credit score required by Truist varies depending on the type of loan, but a representative didn't provide specifics. It helps to know minimum credit score requirements by loan type, though. Conventional loans typically require a score of at least 620, while your credit score can be as low as 500 or 580 with an FHA loan, depending on your down payment.

Both the VA and USDA don't set credit requirements, though the lender might have a minimum. Of course, with any loan program, having a higher credit score can help you qualify for the best mortgage rates. These rates can change every day and are based on a few assumptions.

For instance, the 30-year fixed purchase rate quote assumes your credit score is higher than 740 and your down payment is at least 20%. So everyone won't be able to qualify for the lowest rates. SunTrust Mortgage Customer Service is just one phone call away in case you need their helpful support. The department is also available online and it is possible to send an email as well through a secured network. Moreover, there exists a physical location where you can address all your queries, complaints and grievances through ordinary mails. Recently, the bank has started providing call center service to cater to the requirements of new borrowers.

People can now easily find solutions to their questions pertaining to mortgage financing, refinance options, application and pre-approval requirements. The company that you make your monthly payment to is your mortgage servicer. A mortgage servicer administers mortgage loans, including collecting and recording payments from borrowers. A servicer also handles loan defaults and foreclosures, and may offer programs to avoid foreclosure and to help homeowners who are behind on their payments. With a HELOC, homeowners may borrow against their home equity as needed. Borrowers may choose from three different repayment options, including revolving, interest-only or fixed rate/fixed term.

You can see current sample mortgage rates on the SunTrust website. To get a SunTrust rate quote that's customized to your location, credit score and other factors, you'll have to start the online application process or speak with a loan officer. Conventional borrowers who can provide a down payment as low as 3% can get 15- or 30-year fixed-rate loans or adjustable-rate mortgages with fixed introductory periods of five, seven or 10 years. Additionally, SunTrust Mortgage works with borrowers seeking financing for mortgages that are larger than Fannie Mae's conventional loan limits, known as jumbo loans.

Home equity lines of credit are available as well, but home equity loans are not. But if you can work around those drawbacks, Truist is a great option for most borrowers. It offers all the major mortgage programs, including conventional and government-backed loans, construction loans, and jumbo loans. Truist also gives homebuyers an option between fixed- and adjustable-rate mortgages. With a fixed-rate mortgage, your mortgage rate never changes. This could be a good option if you find a low rate and you prefer predictable payments.

An ARM offers a fixed rate only for a certain amount of time. Then, based on market conditions, the rate may go up or down at specified intervals for the rest of the loan term. So with a 5/6 ARM, for instance, the rate is fixed for the first five years then adjusts every six months. Truist's ARMs are subject to rate caps per adjustment as well as life of loan. Homebuyers can get a Truist mortgage loan in 47 states and Washington, D.C., and customers can apply online, over the phone, or at one of thousands of SunTrust and BB&T branches spread across the U.S.

You can check mortgage rate quotes and find information about the homebuying process on both the SunTrust and BB&T websites. When you start an online mortgage application with either brand, you'll be directed to the Truist Mortgage Origination platform where you'll finish the process. Here's what to know about Truist's mortgages before applying.

SunTrust is a financial services firm that operates across the southeastern U.S. The company offers banking and investment products, credit cards, mortgages, student loans, auto loans, home equity loans, and more. The bank has recently merged with BB&T Bank to form Truist, which should be fully integrated in 2022, making it the sixth-largest bank in the US. Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages.

Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Sun Trust Mortgage is a division of Sun Trust Banks Inc., a major U.S. financial holdings company. With over 170 billion in assets, Sun Trust Bank offers a full range of banking and investment services, including mortgage lending and home equity loans. Our home loan has been transferred to Suntrust Now Truist and this is the first month of mortgage payment which is a huge mess. The mortgage was paid online on August 3rd and I have been getting an email from Suntrust that they have not received the payment. I have called several times and they warn that the wait time is about 25 minutes. I am now on hold for 45 minutes and no one is responding.

It is pretty frustrating not being able to connect with customer service in this company. SunTrust is an American banking company that offers multiple types of mortgage and refinancing options. It was named one of the 2019 Best Mortgage Lenders by NerdWallet for its refinancing and loan options with low and no down payments. It employs local loan officers and provides online applications so you can easily and conveniently get started on the mortgage borrowing process. SunTrust and BB&T are still merging under the Truist brand, so you can look at either website to find information — including rate quotes. Both websites are easy to navigate and offer several tools and resources to help borrowers through the mortgage process.

You'll find calculators, blog posts, videos, and detailed explanations of each mortgage program. You can also call, email, or visit a branch to ask questions, get preapproved, or start a loan application. While your account is in forbearance, you won't have to make your monthly mortgage payments. Payments scheduled during this time won't be reported as late or missed to credit agencies and won't generate penalty fees. Creditors may consider this a risk if you are applying to purchase a new home or refinance in the future. Suntrust is a major nationwide lender with a variety of loan options that can meet almost any customer's needs.

Its retail footprint being only in the southeastern United States means that if you want to meet your loan officer face-to-face, you need to live near one of its branches. However, what it lacks in retail presence, it makes up for in online and on-the-phone service. You can apply from your phone, your iPad, any mobile device, as well as your computer and conduct the entire process online. Allows qualified buyers purchasing a home in certain rural areas to purchase a home with 100% financing – in other words, no money down.

Income limits apply – the borrower has to earn 115% of the US median income or less, to qualify. Currently, the US median income is approximately $59,000 annually, so 115%, or $67,850, the maximum one can earn to qualify for a USDA loan. The loan amount may be increased to include the financing of some closing costs if the home appraises higher than the purchase price.

SunTrust offers Fixed-Rate Mortgages, which is the most common type of mortgage loan. Fixed-rate loans include a fixed monthly payment and fixed interest rate for the duration of the loan. This post dives into detail on SunTrust's mortgage services. The above phone number is available 24 hours a day 7 days a week.

You can get solutions to all issues pertaining to mortgage payments, loan application, loan modification programs, homeowner assistance, foreclosures, REO properties and many more. SunTrust has several mortgage loan options for low- and moderate-income home buyers. The down payment requirement on affordable SunTrust mortgages is between 0% and 5%, depending on the home loan type. Best of all, some of those programs come with reduced private mortgage insurance requirements.

Sun Trust Mortgage offers both standard home equity loans and home equity lines of credit . The SunTrust home equity loan allows homeowners to borrow a single lump sum to be repaid over a set period of time at a fixed interest rate. Sun Trust Mortgage offers a variety of mortgage refinance programs to meet the needs of a broad range of borrowers. SunTrust is a bank with a full range of online services, as well as in-store offerings in select locations nationwide. SunTrust provides multiple mortgage types, refinancing and other loan options.

You can apply online for its standard and unconventional mortgage products. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. SunTrust Mortgage is a major mortgage lender that offers a variety of loan products to customers across the economic spectrum and pairs those offerings with flexible, easy-to-access customer service options. You can find a list and explanation of necessary documents in SunTrust's 20-page home buying guide. You may be asked to disclose any car, student or home loans not listed on your credit report, plus all credit cards. To start the mortgage process with SunTrust, you can apply online , email, call or go to a local branch tomeet with a loan officer.

If you want to meet with a loan officer, use the representative locator on the website to find your local representative. If there isn't a loan officer in your area, you can call the main mortgage application number or apply online. It's always a tricky question to answer, whether you'd qualify for a mortgage. SunTrust will analyze your credit history to look for red flags and overall creditworthiness.

If you have a "good"credit score, that'll increase your eligibility for a conventional loan, which carry the best interest rates. If your credit isn't quite that good, you still have other options for loans, usually government-backed. SunTrust doesn't specify what scores are required for its loan offerings such as the Fannie Mae and Freddie Mac programs.

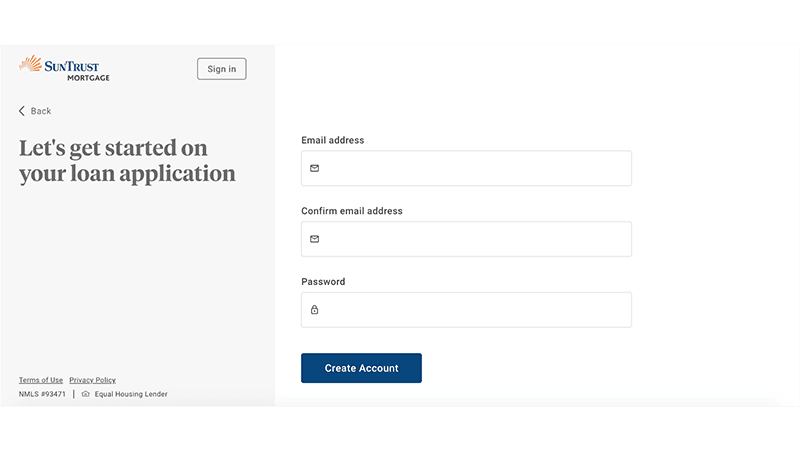

You'll have to initiate a pre-qualification, loan application or speak to a representative to find out. You can prequalify for a loan online as well as start the application process. Unlike other lenders, you won't need a loan number to get an online account; you can sign up for one immediately. Your account will allow you to track your information online and make mortgage payments, as well as request statement or loan documents.

Truist Bank became the seventh-largest commercial bank in the U.S. after SunTrust Bank and BB&T Corp. merged in 2019. Truist is now based in Charlotte, North Carolina, and is in the process of moving every product under one retail line. As a full-service bank, customers can find consumer banking services, mortgages, home equity products, credit cards, investment products, and several types of loans. Prior to closing, the mortgage company will calculate how much they need to add to your mortgage payment to cover these obligations based on the information available. Available information is usually an insurance quote or premium amount for existing coverage, and tax bill information from the previous year.

If there is a shortage in any year, you will be required to pay that difference. If there is a surplus, you will receive a credit or refund. Every year SunTrust will review your escrow account to recalculate the amount you pay based on the most recent billing information.

Some of the loan plans offered by the provider include Jumbo loans, adjustable-rate mortgage, FHA loans, VA loans, cash-out refinance, and fixed mortgages. The initial process to get a loan can be started online, and once the preapproval has been passed, you will be assigned a loan officer who will work you through the loan process. As with the agency loans, there are no changes to the rate or payments. However, these loans are well-suited to those who have limited funds for a down payment or whose credit history is not pristine. Where most agency loans prefer that you have a 720 credit score, FHA loans allow for 660 or lower and down payments as low as 3.5%. The maximum loan, depending on the location of the property, is $679,750.

Suntrust's jumbo loans also have significant reserve requirements. This means that, in addition to proving the availability of the down payment and closing costs, the borrower must have six or months of monthly payments in assets that can be liquidated in an emergency. Suntrust has a full complement of mortgage products, offering nine standard mortgage products and three types of specialty mortgages. Suntrust does not offer loans for people with alternative credit or income that is challenging to document. SunTrust offers flexible mortgage loan options for low-, moderate- and high-income earners.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.